- Details

With the potential to generate significant returns, cryptocurrencies have become a favourite of many investors. However, not everyone has enough expertise or financial and technological knowledge required for successful investments.

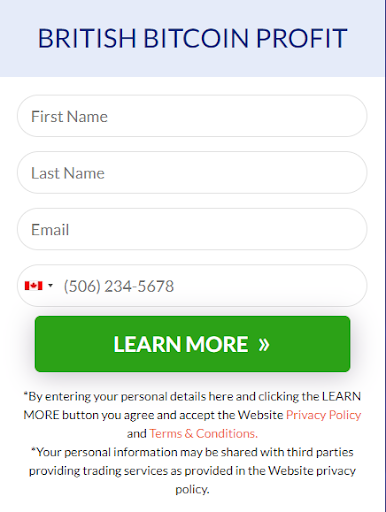

Despite this, there are plenty of people who take their chances in the crypto market. To help you stay ahead of the curve, we'll list some common mistakes that occur with cryptocurrency investments so you can be mindful when pursuing them. If you want to learn more about trading bitcoin, you can click on the image link below:

Most Common Crypto Investment Regrets

Following an Influencer Blindly

Numerous industry experts say that social media influencers are correct to motivate individuals to buy electronic currencies, especially young people. A variety of prominent figures and celebs endorse digital assets, aiming to generate income from them by enticing individuals with very little or maybe no awareness of crypto and investing. Frequently, blind trust in these types of folks results in catastrophe.

Influencers, to set it one other way, might have erroneous motives for discussing assets in a particular way. They might be compensated to market a particular task that could turn out to be a rug pull or maybe they might not possess the experience to offer investment advice, frequently depending on non-credible and unverified sources. In case you wish to stay away from the trap of thinking of the incorrect influencer, you need to steer clear from businesses that will guarantee very high profits, who hype their crypto tasks, and who employ anonymous members of staff. Just like any investment, you have to carry out some investigation before you truly commit to anything.

Investing More Than You Can Afford to Lose

Numerous individuals have been the victims of rip-offs in the crypto area, committing their money into electronic property and then asking them to fall apart in just minutes, and even worse, turning into a rug-pull scam. Putting all of your money in electronic coins is wagering, and it isn't great to do. Digital money is a very volatile commodity. An investment can drop in value and in case it does, you might lose everything or receive a refund, based on how much you invested.

That is exactly why you shouldn't invest a lot more than you can afford to lose, along with that is among the most essential investment rules. Traders and investors who don't have a strategy before they get into the marketplace are never all-in. Rules bring discipline and also create a structure which shields you from making quick decisions, maintains trades in check and also, in the end, raises investment returns.

Selling Prematurely

Aside from investors, not concentrating on the long run is very popular and it is influenced mainly by human psychology, which usually results in irrational behaviour at times when cold-blooded, a.k.a. logical, decision-making is required. Numerous investors have spoken about their reservations about marketing their crypto assets immediately whenever they begin to display profits, rapidly cashing in on the earnings as they worry the price will fall as well as the cost increase will disappear.

Many people put their personal property on the edge of the coin once the price starts to drop. Even though the golden rule of investing states "Buy low, sell high," the inclination to offer property is intense whenever they go through a dramatic decline, and regrettably this results in losses. However, the truth is that markets often develop as well as expand as time passes, in which highs are followed by increased highs. Holding on to assets or working with the 'Dollar-Cost Averaging 'strategy can make it possible to minimize bad emotions, stay away from costly mistakes and even wind up with huge profits in a single day.